Optimizing Digital Banking

Client: A Top-4 U.S. Retail Bank serving 70M+ customers

Overview

Challenge

Our client’s checking account application drop-offs and abandonment rates after account opening were increasing. My team was engaged to determine why abandonment rates were increasing, put together a strategy to remedy this, and align silo-ed business units around a prioritized roadmap.

Responsibilities

Design and Product Strategy: I led the design strategy for this project, working alongside a cross-functional team of researchers and consultants. I led the end-to-end experiential and competitive audit, integrated quant + qual insights into product recommendations, led ideation, and solution prioritization.

Stakeholder Management: I owned key aspects of the client relationship—delivering key executive-facing readouts and engaging in ad strategy hoc sessions with the Head of Design and the Head of Consumer Digital to ensure our insights were gaining consensus across internal client silos

Impact

In 10 weeks, we moved from internal ambiguity with disparate perspectives to a clear, unified, path forward.

Executive Buy-In: Our client’s culture was known to be silo-ed and political and we experienced that first hand. Achieving consensus among stakeholders on the path forward was accomplished through thoughtful stakeholder management and sharp insights backed up by robust data and research.

A Prioritized Growth Roadmap: We translated our insights into ~20 strategic opportunities, several of which were immediately added to the bank's active product roadmap.

Quick Wins: Immediate UI fixes, such as optimizing information hierarchy on marketing landing pages and introducing progress trackers to reduce cognitive load.

Strategic Big Projects: High-impact initiatives like integrating third-party digital direct deposit (e.g., Atomic) to drive immediate account funding—a key driver of customer primacy

Process

The Strategic Approach: Insights to Action

First, we needed to understand the user needs, actions, and landscape

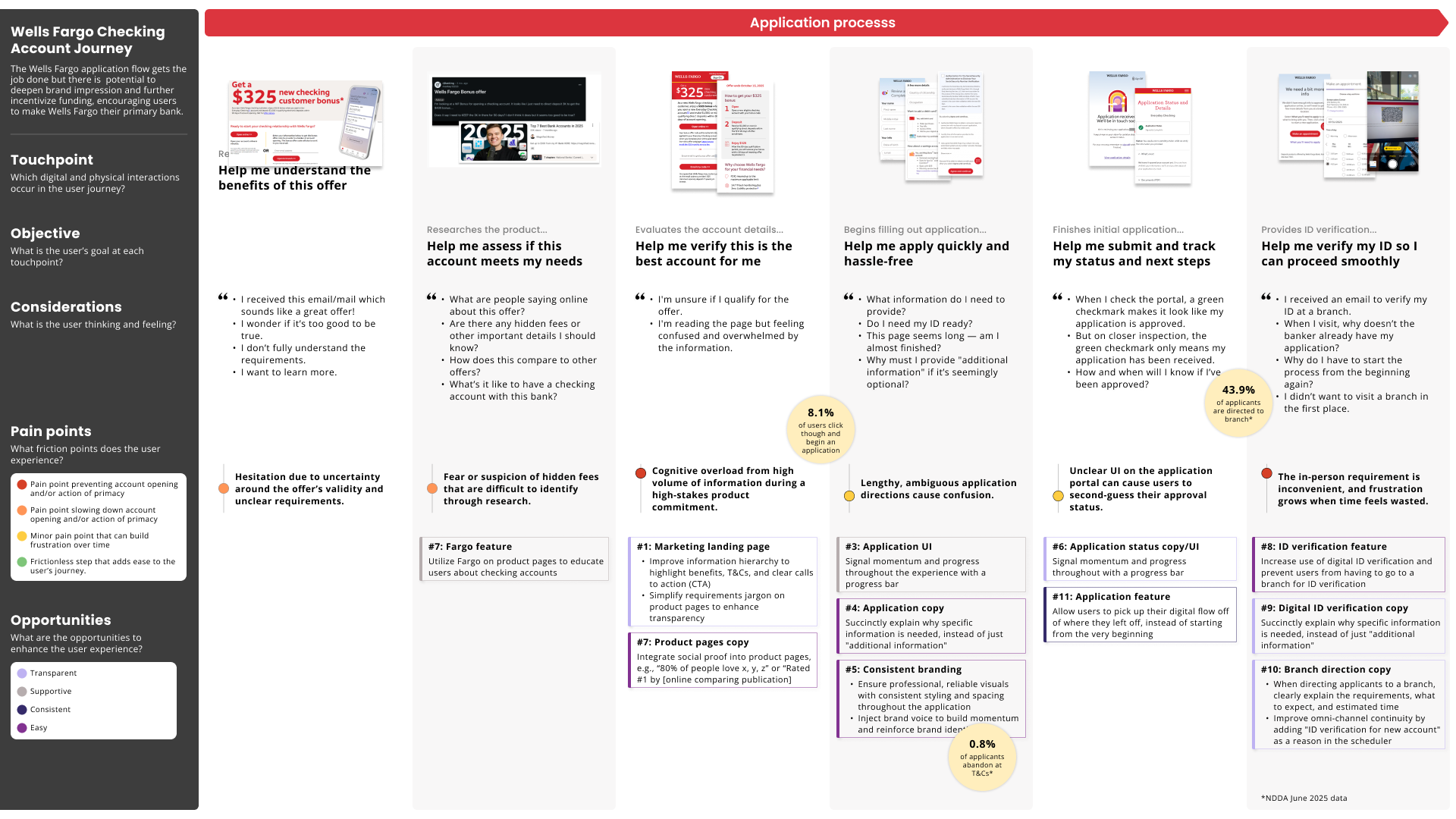

Experiential & Competitive Audit: I benchmarked the bank’s onboarding experience against six key competitors—ranging from legacy peers to digital-native disruptors. We also received data from the client to understand where dropoffs were occuring.

Qualitative Diary Studies: We followed customers through the process of applying for checking accounts, identifying perceived commitment points where users were most likely to drop off.

Quantitative Pulse Survey (N=503): To quantify user pain points, confirming that 64% of customers view convenience as the primary driver for improving their financial lives.

Journey Map: I synthesized these findings into a customer journey map, highlighting the gap between user goals and current pain points

From our primary research, we uncovered 4 key themes that represent the needs throughout a user’s application journey. Our recommendations were centered around ensuring these user needs were met.

Transparent: Show what’s needed and what’s coming

Reliable: Be consistent and dependable

Supportive: Guide and empower users

Simple: Keep it clear, easy, focused

Gap Assessment & Recommendation Development

I then led the effort to synthesize these findings into two core assets the working team could use

Deep Dive Takeaways: For the everyday working team, we created a detailed analysis of each stage in the client customer’s journey, supplemented with a competitive analysis and qualitative data to back up our findings

A High Level Customer Journey Map: We visualized the friction areas and opportunities, creating a shared source of truth for the working team.